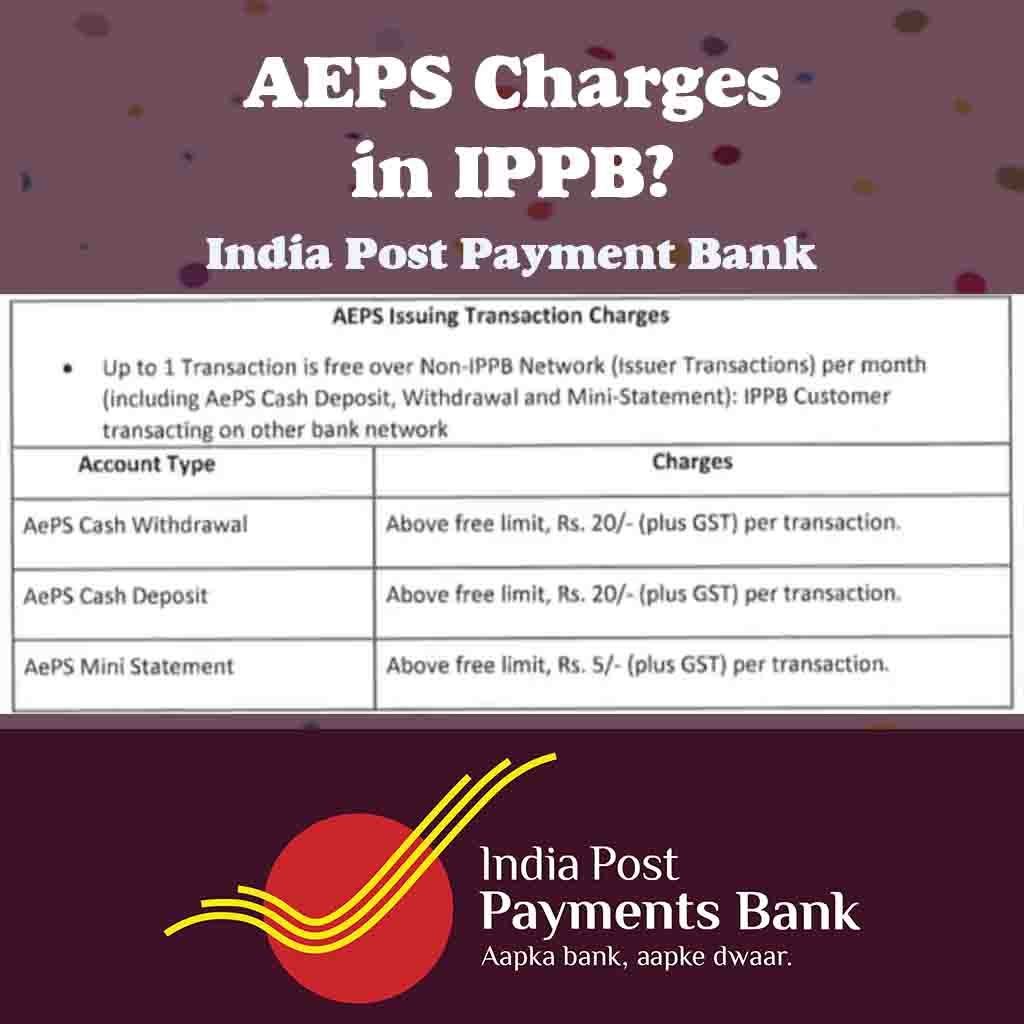

What are the AEPS Charges in IPPB?

The Aadhaar Enabled Payment System (AEPS) is an electronic payment system that allows customers to perform financial transactions using their Aadhaar number and biometric authentication. India Post Payments Bank (IPPB) is a government-owned payments bank that offers AEPS services to its customers. In this article, we will explore the AEPS charges levied by IPPB.

What is AEPS?

AEPS is a payment system that allows customers to perform banking transactions such as cash withdrawal, balance inquiry, and fund transfer using their Aadhaar number and biometric authentication. The system was introduced by the National Payments Corporation of India (NPCI) to promote financial inclusion and reduce the dependency on cash transactions.

What are AEPS Charges?

AEPS charges refer to the fees levied by banks for using the AEPS service. These charges are determined by the bank and may vary depending on the transaction type, amount, and location. The charges may also vary based on whether the transaction is done through a business correspondent or at the bank branch.

AEPS Charges in IPPB

IPPB is one of the banks that offer AEPS services to its customers. The bank charges a nominal fee for using the AEPS service, and the charges are as follows:

- Cash withdrawal: For cash withdrawals up to Rs. 10,000, IPPB charges a fee of Rs. 25 per transaction. For cash withdrawals above Rs. 10,000, a fee of Rs. 2.50 per thousand or part thereof, subject to a minimum of Rs. 25 and a maximum of Rs. 10,000, is charged.

- Balance Inquiry: IPPB charges a fee of Rs. 2 for balance inquiry through AEPS.

- Mini statement: A fee of Rs. 5 is charged for availing mini statement through AEPS.

- Fund transfer: For fund transfers up to Rs. 5,000, IPPB charges a fee of Rs. 2.50 per transaction. For fund transfers above Rs. 5,000, a fee of Rs. 5 per transaction is charged.

It is important to note that the above charges are exclusive of GST, and the charges may vary depending on the location and type of transaction.

Related Aticles

Conclusion

The AEPS service offered by IPPB is an excellent initiative to promote financial inclusion and encourage digital transactions. While the AEPS charges levied by IPPB are nominal, it is essential to be aware of the charges before using the service to avoid any surprises. Customers should also ensure that they have sufficient funds in their account to avoid any penalties for insufficient funds. Overall, the AEPS service is an efficient and convenient way to perform financial transactions, and customers should take advantage of the service to experience its benefits.

FAQs – Frequently Asked Questions

Q: What is IPPB?

A: IPPB (India Post Payments Bank) is a government-owned payments bank that offers banking services to its customers, including AEPS services.

Q: What are AEPS charges?

A: AEPS charges refer to the fees levied by banks for using the AEPS service. These charges may vary depending on the bank, transaction type, amount, and location.

Q: What are the AEPS charges levied by IPPB?

A: IPPB charges a nominal fee for using the AEPS service, which varies depending on the transaction type. For example, for cash withdrawals up to Rs. 10,000, IPPB charges a fee of Rs. 25 per transaction.

Q: Are there any additional charges levied by IPPB for using AEPS services?

A: Yes, the AEPS charges levied by IPPB are exclusive of GST, and additional charges may apply depending on the location and type of transaction.

Q: Can I use AEPS services at IPPB without paying any charges?

A: No, IPPB charges a nominal fee for using AEPS services, which varies depending on the transaction type.

Q: Can I get a refund for AEPS charges levied by IPPB?

A: No, AEPS charges are non-refundable, and customers are required to pay the fees for using the service.

Q: How can I avoid paying AEPS charges at IPPB?

A: It is not possible to avoid paying AEPS charges at IPPB as the charges are a standard fee for using the service. However, customers can minimize the charges by performing fewer transactions or by choosing the transaction type that incurs lower fees.

Q: Are AEPS charges at IPPB competitive with other banks?

A: Yes, the AEPS charges levied by IPPB are competitive with other banks and are considered to be nominal.